In the venture capital industry, we have heard of two sayings: “betting on players” and “betting on tracks”. Two of the most brisk companies in China are IDG and Sequoia Capital, who have accomplished about 300 and 200 investments. This article looks into 50 cases of all the investments and draws some conclusions.

The paragon of “betting on players”: IDG

IDG, established in 1992, is an inspiring teacher to Chinese entrepreneurs in the field of capital. It is the forerunner of VC in China, with a well-known name almost synonym to VC. It invested approximately 300 Chinese Internet companies, covering representative firms of almost all the fields.

The representative figures of IDG are investors such as Xiong Xiaoge (熊晓鸽)、Lin Dongliang (林栋梁), Zhou Quan (周全) and Zhang Suyang (章苏阳). They detect worthy entrepreneurs in their early stage and gave them first-round investments. As the companies develop, other investors will follow, until the companies are listed.

In 1999, Zhang Suyang discovered Ctrip (携程). In October that year, he invested just 430 thousand dollars in it. In the following March, he cautiously put in another 500 thousand. During the four years after IDG’s investment, Morningside Ventures (晨兴创投), SIH (Shanghai Industrial Holding, 上实控股), SBC (SoftBank China Venture Capital, 软银中国), Orchid Asia (兰馨亚洲), Carlyle (凯雷) and Tiger Fund (老虎基金) followed its lead and pushed Ctrip all the way onto the NASDAQ.

The same procedure goes with Xunlei (迅雷). In December, 2013, IDG invested 1 million in it. Then in 2005 and 2007, IDG allies with Morningside, Fidelity Asia (富达亚洲) and Ceyuan (联创策源) to launch two rounds of investments. In 2011, the Murdoch Family Foundation invested 29.4 million dollars in Xunlei.

土豆网 is also first discovered by IDG. In 2005, IDG invested 500 thousand dollars and gained 30% stock ownership of it. IDG participated in the following four rounds of investments, followed by GGV (纪源资本)、Capital Today (今日资本) and Temasek (淡马锡).

IDG’s investments into those failed companies and companies that are still struggling their way to success are of great importance, for they usually invest in pioneers of an industry. Their investments allow entrepreneurs to have a chance to reach out for their dreams. Win or lose, they leave themselves and late comers valuable lessons. The 20 million investment into ZZnode (直真节点) in 2001 and the 2004 investment in 8848 are representatives of this kind of investment.

Somehow, after year 2007, IDG seem to have lost the wisdom it used to possess. The only listed company in its investment list is 9158.

In August, 2007, IDG spent 2 million dollars on Vancl (凡客诚品), taking up 15% of shares. In February 2014, the investment has progressed to round H. In each round, the amount is getting bigger: from 30 million dollars to 48.8 million. In one round, the amount raised up to 2.3 hundred million dollars. In another three rounds, the amounts are equally 1 hundred million dollars. In addition to spending “silly money” of their own, IDG also invited Qiming Venture (启明创投), SAIF, Tiger Fund and Temasek to join the follow-up investment, which will inevitably become a burden to these companies.

IDG’s valuation of Mogujie (蘑菇街) and Secoo (寺库), according to the investment amount (2 hundred million and 1 hundred million dollars), is obviously on the high side, with higher risk and lower profit.

What is puzzling is that IDG has invested in Haoqiao.cn (好巧网), which professionalizes in hotel search and price parity. Nowadays, Ctrip and Qunar are devouring the market, while 艺龙 is struggling in between. Tuniu, which succeeded on oversea guided tours, has been listed and joined Ctrip. In a world where price parity is out and customized travel companies are receiving investment from Tencent, Jack Ma and Shi Yuzhu, who else will believe in betting on Haoqiao other than IDG?

(In IDG’s defense, an employee said that they have started “betting on tracks” a long time ago. Yet different from 红杉’s choice, they were betting on mobile device and applications: Xiaomi, Mogujie, MYOTee, etc. )

Winner of “betting on tracks”: Sequoia Capital

“Betting on tracks” is an old tradition of Sequoia Capital U.S. In China, however, with the relentless march of Internet, it is not even easy to see the tracks clearly, not to mention betting on them.

Before 2008, Sequoia invested in Autonavi (高德软件), Dianping (大众点评), Qihoo (奇虎360), Uusee (悠视网), Bona Film (博纳影业) and 小天鹅餐饮. The 1.2 million dollars received by NQ (网秦) in 2007 also came from Sequoia Capital. By that time, Sequoia Capital was casting their net widely without any guidelines.

In January 1, 2008, after its investment in Lefeng (乐峰), Sequoia Capital began to see the Internet field clearly and chose four tracks, including electronic commerce, travelling, O2O and vertical community, Internet finance (it also invested in some education programs in 2008, then almost gave up the education track). A common character of these industry is “close to money”. Even if it is a community, it is a vertical community that focuses on a certain topic, with a clear way to realization.

In 2008, 红杉 rose a rapid rise. It completed nearly 200 investments, including JD.com, VIPshop, Jumei, Tuniu、Bai'ao (百奥家庭), Jiuxian (酒仙网), Ppdai.com (拍拍贷), Lefeng. Almost all of the E-commerce financing stories involve Sequoia. It literally bought the “Chinese E-commerce track”.

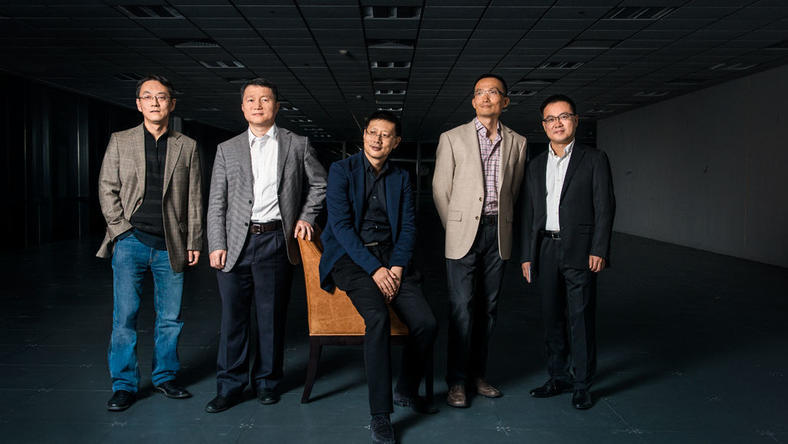

A group represented by Neil Shen (沈南鹏)、Steven Ji (计越) and Kui Zhou (周逵) has gradually formed the ability of judging the developing trend of an industry. This ability has become the core advantage of Sequoia. Depending on its rich connections and its outstanding brand, 红杉 can always join the financing of relatively excellent programs, such as JD, Jumei and VIPshop. Besides E-commerce, Sequoia also intensively invested in the field of travelling and transporting. Among these companies, Autonavi and Tuniu have been listed successfully. The only failure is Yaoyao taxi (摇摇招车).

Sequoia also has its layout in O2O, vertical community and the uprising Internet finance. For 红杉, investments are risky, but not investing brings higher risks. For example, in Internet finance, even if all the four companies it invested in are “dead”, the loss is just 1 hundred million dollars. If it does not invest now, investment chances will slip away when one of these four companies comes to maturity.

By the mentioned investments ( there are dozens besides the 34 listed in the article), Sequoia has constructed strong clusters and set up a good brand in hot fields such as E-commerce and O2O. Some programs have come to the season of harvest. In the predictable three to four years, Sequoia will be enjoying its time.

The investing strategy of Sequoia is extensive cultivation. It seems to yield very little, but in fact suits the characteristics of emerging industry and is less risky.

Why betting on tracks instead of betting on players?

In spite of IDG, some other famous VC companies also have won glorious battles in the war of betting on players.

In 2000, Masayoshi Son invested 20 million dollars in the group led by Jack Ma. In 2003, he put in another 80 million dollars to Alibaba. In 2005, he participated again in Yahoo’s investment in Alibaba. Eventually, he holds 34.4% of Alibaba’s shares before Alibaba go on the list and becomes the biggest shareholder. In 2013, the assets of Sun is 19 billion dollars. If, after Alibaba is listed, the market value of the company raises up to 200 billion dollars, Sun will become the richest man in the world with a value of over 80 billion dollars. Sun’s SBC, however, did not bet continuously on the heated Chinese E-commerce.

Ms. Xin Xu (徐新) from Today Capital bets on Qiangdong Liu (刘强东). In 2007, she acquired 33% stocks of JD by investing 10 million dollars. In 2009, 今日资本 allied with Bull Capital and Francis Leung (梁伯韬) and invested 21 million dollars in JD. Of the following rounds of JD's financing, Today Capital gradually sold parts of its shares and has already recovered its original investment. Before JD was listed, it still held 1.93 hundred million common shares, a market value of 5 billion dollars. It becomes a legend that only Sun has the chance to transcend.

Xu’s investment programs have aroused many controversy, especially in the cases of Zhen Gong Fu (真功夫)、Ganji (赶集网) and Tudou (土豆网). In these teams, husband and wife turned against each other, members of the team quitted the job, which have become a figure of fun within the VC circle. The founder of Inoherb (相宜本草) was not happy working with Xu. After coming into the market, he publicly rebuked Xu as a “liar”. In the recent years, Today Capital (今日资本) invests in only a few programs: Lao Xiang Ji (老乡鸡), 1.29 hundred million, Mafengwo.com (20 million dollars), 3songshu (6 million dollars), which all perform poorly. However, by betting on Liu, it has made a net profit of 5 billion dollars. It is a battle that made Xu and her Today Capital a key role in the VC world.

The capacity of IDG in betting on players is astonishing. The players it bet on: Charles Zhang (张朝阳), Pony Ma (马华腾), Robin Li (李彦宏), Tianquan Mo (莫天全), James Liang (梁建章), Hongyi Zhou (周鸿祎) and so on, are all outstanding personalities. In February 2000, Robin Li brought 1.2 million dollars of VC back from oversea to establish Baidu. In August, the Beta version of the Baidu search engine was completed. The 10 million dollars invested by IDG in September is vital to Baidu. This investment later brings over 100 times of profit to IDG.

After 2007, IDG has not done another brilliant case. It is not because their investors lost their wisdom, but because the times have changed. Ten years ago, the Internet world of China is a place of untamed wilderness without tracks or even playgrounds, programs and rules. Back then, “betting on tracks” is nothing but a joke. What’s important is the quality, guts and charisma of the founders.

Today, however, things are different. Not only are tracks built, we also have BAT. If Jack Ma, Liu and Robin Li are thirty years younger, as founders of today, they will find their chances of success much slimmer. In this circumstance, betting on tracks is the best strategy. Take Sequoia for example. It invested in a dozen of E-commerce companies, “buying” all the potentially powerful players on the track. No matter who win the gold, silver and bronze medal, Sequoia will become the ultimate winner by collecting ten times or even tens of times of profits.